1. Create a Budget and Stick to it: Develop a detailed budget that accounts for both fixed and variable expenses. Include essentials such as housing, utilities, insurance premiums, groceries, and transportation, as well as discretionary spending categories. Be realistic about your income and expenses, considering both high and low earning periods.

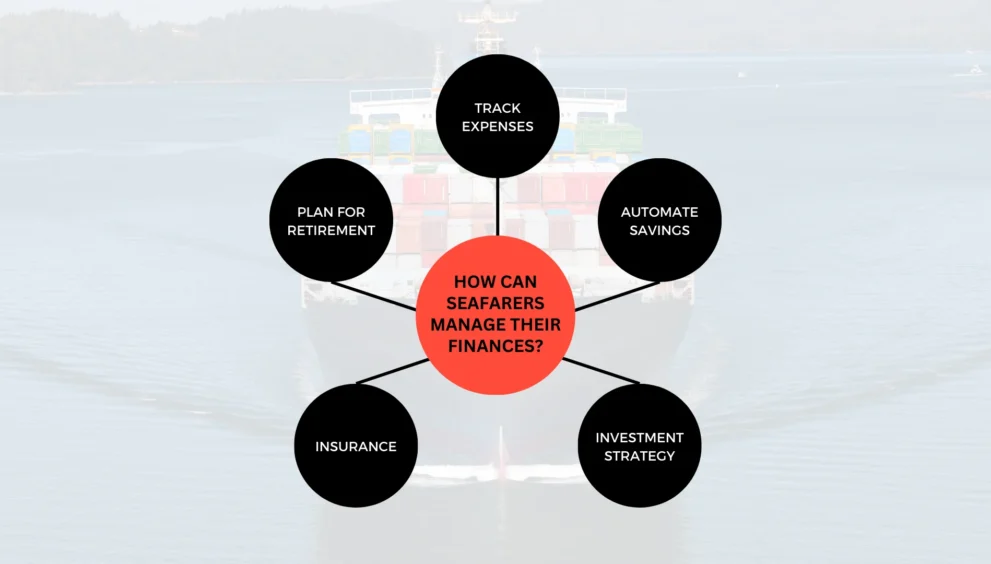

2. Track Expenses: Keep track of your expenses to understand your spending patterns better. Use mobile apps or spreadsheets to monitor your spending while at sea and when on shore leave. Review your expenses regularly to identify areas where you can cut back or adjust your budget.

Build an Emergency Fund: Establish an emergency fund to cover at least 3-6 months’ worth of living expenses. This fund acts as a financial safety net during periods of unemployment, unexpected expenses, or emergencies. Contribute to your emergency fund consistently, especially during high-earning periods.

3. Save regularly/Automate savings: Set up automatic transfers from your checking account to your savings or investment accounts. This ensures that a portion of your income is allocated towards savings and investments before you have the chance to spend it.

4. Save more during High-Earning periods: Seafarers often experience peak earning periods during certain contracts or assignments. Use these periods to save aggressively and build up your savings accounts, emergency fund, and retirement accounts.

5. Diversify Income Streams: Explore opportunities to diversify your income streams to reduce reliance on a single source of income. Consider investments, side businesses, or freelance work that you can pursue during your time off or while at sea (if feasible).

6. Manage Debt Wisely: Minimize high-interest debt such as credit card debt and payday loans, as they can quickly erode your income. Prioritize paying off existing debts systematically, starting with those with the highest interest rates.

7. Plan for Retirement: Despite the irregular nature of seafaring employment, prioritize retirement savings. Contribute to retirement accounts such as national pension schemes during high-earning periods. Consider the portability of retirement accounts and seek professional advice to optimize your retirement savings strategy.

8. Investment Strategy: Diversify your investment portfolio across different asset classes such as stocks, bonds, mutual funds, real estate, and commodities. Prioritize investments that offer liquidity and flexibility given the uncertain nature of seafaring employment. It’s crucial to balance risk and return based on individual financial goals and risk tolerance.

9. Tax planning: Understand the tax implications of your income, especially if you’re working internationally or in countries with complex tax systems. Take advantage of tax-saving investment options available in your country, such as retirement accounts or tax-efficient investment vehicles.

10. Insurance: Invest in comprehensive health insurance that covers medical expenses both domestically and internationally. Consider purchasing life insurance to provide financial security to your dependents in case of your untimely demise. Protect yourself against the risk of disability by investing in disability insurance which ensures you have a source of income if you’re unable to work due to an injury or illness.

11. Long-term Financial Goals: Identify your long-term financial goals, such as buying a home, funding your children’s education, or starting a business. Develop a plan to achieve these goals through disciplined saving and investing. Review and adjust your financial plan regularly to accommodate changes in your circumstances, income, or financial goals.

12. Monitor Currency Exchange Rates: Seafarers working internationally should be mindful of currency exchange rates, as fluctuations can impact income and expenses. Consider using currency hedging strategies or maintaining accounts in multiple currencies to mitigate currency risk.

13. Seek Financial Advice: Consider consulting with a financial advisor who understands the unique challenges of seafaring careers. A financial advisor can help you develop a tailored financial plan, navigate tax implications, and make informed decisions about savings, investments, and insurance. You can always contact us for one-on-one financial guidance.